Background

Sustainable finance, which denotes the incorporation of environmental, social and governance (ESG) factors into investment decision-making, is increasingly central to fostering sustainable economic initiatives and projects globally. As this field gains traction, the primary instruments used include green bonds, social bonds, sustainable bonds and sustainability-linked bonds (GSS). The International Capital Market Association (ICMA) provides crucial guiding principles for these issuances, supporting the robust development of the sustainable debt capital markets.

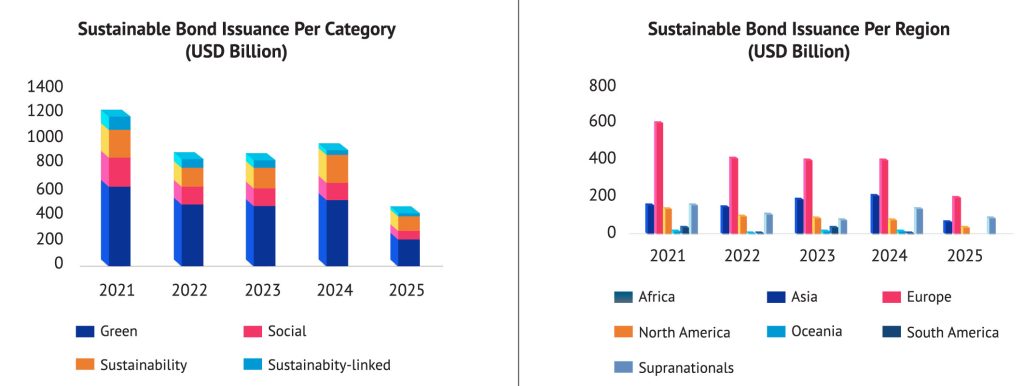

The global sustainable finance market issuance volume has grown significantly with cumulative GSS at approximately USD 6.9 trillion in 2024 (2023: USD 4.4 trillion), driven by increased awareness and the growing concern from investors on best practice. Green bonds remain the dominant category, accounting for over 50% of total issuances, whereas sustainability-linked issuances constitute less than 10%. Looking ahead, the Climate Bonds Initiative (CBI) estimates that the total cumulative volume of GSS issuances is on track to exceed USD 8 trillion by the end of 2026.

Figure 1: Global Sustainable Finance Market Size (As at 24 July 2025)

Source: International Capital Markets Association (ICMA) – 24 July 2025

To bolster market activity and credibility, international and local frameworks have been established to promote transparency and consistency. Global standards, such as the Climate Bonds Standard and Taxonomy by the CBI and the Climate Disclosure Standards Board (CDSB), offer guidance on identifying climate-aligned assets and enhancing climate-related disclosures. The Global Reporting Initiative (GRI) supports comprehensive sustainability reporting, while the ICMA principles define best practices for aligning debt with sustainability goals. Furthermore, IFRS S1 and S2 standards, issued by the International Sustainability Standards Board (ISSB) and effective from 1 January 2024, mandate general and climate-specific sustainability-related financial disclosures.

This momentum reflects a fundamental shift. Agusto & Co. notes that sustainability is no longer merely a strategic option but a necessary response to global challenges like climate change, resource depletion and social inequality. Sustainable finance represents a pivotal evolution in how capital is mobilised to support a greener, more inclusive and resilient future.

The African Sustainability Perspective

In Africa, the pursuit of long-term development is increasingly shaped by the need to balance economic advancement with environmental stewardship and inclusive social progress. Exposed to significant climate-related risks, the continent has embraced responsible growth models anchored in global initiatives such as the Paris Climate Agreement and the United Nations Sustainable Development Goals (SDGs), which serve as a blueprint for development priorities.

Despite this, Africa’s participation in the global sustainable finance market remains nascent. In 2024, of the total USD 892.7bn in sustainable finance issuances, Africa accounted for a mere 0.26%. This trend continued into the first half of 2025, where total issuances in Africa stood at USD 1.28bn, representing just 0.3% of the global volume. This highlights the structural challenges the continent faces in mobilising sustainable capital. In the near term, Agusto & Co. expects the volume of issuances to rise, driven by the urgent need to address climate change impacts as well as growing investor demand. While green bonds continue to dominate the global sustainable finance market compared to social and sustainability-linked bonds, the Climate Bonds Initiative (CBI) Sustainable Debt Global State of the Market 2024 Report indicates that the green bond issuance volume in Africa fell by 25% to USD 1.35bn with the Africa Development Bank (AFDB) being the dominant issuer, accounting for 69.6% (USD 0.94bn) of those issuances. This trend presents a significant constraint to the continent’s ambition to leapfrog the challenges posed by climate change, resource depletion and social inequalities and transition to a greener, more equitable and sustainable future.

Capital markets have a vital role to play in reversing this trend by channelling long-term funding into aligned projects. Efficient capital market infrastructure, such as stock exchanges and derivatives exchanges, are at a pressure point in the investment chain and can exert influence on entities, issuers and other investment stakeholders. Agusto & Co. notes that effective mobilisation of funds through instruments such as commercial papers, asset-backed securities and bonds is essential to deepening sustainable finance across Africa. To this end, targeted capacity building for key market participants, including issuers, investors and regulators, is pivotal for raising awareness and fostering greater uptake of these instruments.

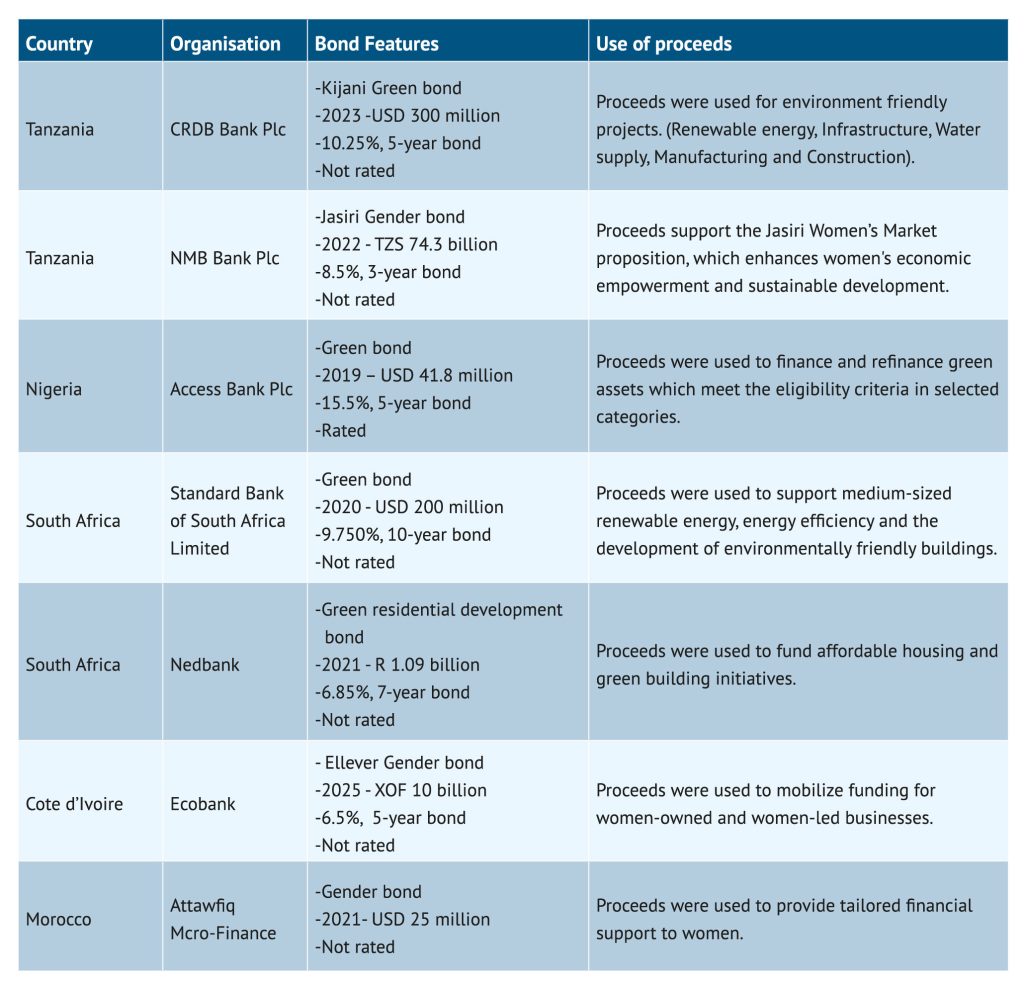

Over the last five years, notable momentum has been building. Financial institutions across the continent are embedding sustainability into their core operations, as seen with CRDB Bank Plc and NMB Bank Plc in Tanzania, Access Bank Plc in Nigeria, Standard Bank of South Africa, Ecobank in Côte d’Ivoire and Attawfiq Micro-Finance in Morocco. This reflects a growing shift towards aligning financial flows with long-term societal and environmental goals.

Table 1: List of Financial Institutions in Africa that have Accessed the Sustainable Finance Market

Source: Financial reports of selected banks, Attawfiq micro-finance.

We expect this momentum to strengthen in the near to medium term, supported by growing investor appetite for ESG-aligned projects, increasing regulatory guidance and enhanced disclosure practices across African markets. As awareness deepens and frameworks mature, more financial institutions and corporates are likely to tap into the sustainable finance space, not only to diversify funding sources but also to meet evolving stakeholder expectations. We also anticipate greater innovation in the structuring of sustainable debt instruments, particularly among local issuers, as they seek to address climate vulnerabilities and foster inclusive growth unique to their regions.

Even as markets increase the uptake of sustainable finance, scrutiny over sustainability claims intensifies. Similarly, ESG ratings have emerged as a key benchmark for performance and accountability – a signal that transparency and credibility are becoming non-negotiables in sustainable finance. In this context, third-party verification plays a critical role in validating sustainability credentials. Agusto & Co., as an approved Green Bond Verifier by the Climate Bonds Standard, contributes to this ecosystem by offering independent assessments (second party opinion and certification) that enhance investor confidence, ensure compliance with global standards and uphold the integrity of sustainable financial instruments in the market.

Kenya’s Sustainability Journey

Kenya stands at a pivotal moment where climate vulnerability and economic ambition converge, demanding innovative financing solutions. Unlocking the full potential of its capital markets through sustainable finance is a policy imperative and a strategic opportunity to build a more resilient, inclusive and environmentally sound economy.

The country’s progress has been shaped by a proactive regulatory environment. The Central Bank of Kenya (CBK), Capital Markets Authority (CMA), Nairobi Securities Exchange (NSE), and Kenya Bankers Association (KBA) have collectively established a robust framework. Key milestones include the KBA’s Sustainable Finance Initiative (2013), the CMA’s Green Bond Policy Guidance Note (2019) and the NSE’s Green Bond Guidelines. These regulatory efforts are strategically aligned with Kenya’s national development plan. The sustainable finance agenda provides a direct funding mechanism for the government’s Bottom-Up Economic Transformation Agenda (BETA), which prioritises key sectors such as agriculture, affordable housing and infrastructure, Micro, Small and Medium Enterprises (MSMEs) and healthcare.

In April 2025, the Kenya Green Finance Taxonomy (KGFT) and the Climate Risk Disclosure Framework (CRDF) were launched by the CBK to assist market participants in identifying and reporting environmentally sustainable activities. The KGFT outlines the minimum set of assets, projects, activities and sectors that are eligible to be defined as green in line with international and best practices and national priorities. Agusto & Co. views this as a key milestone, which is expected to steer financing toward investments that are not only profitable but also environmentally sound. In addition, the Government of Kenya continues to offer tax incentives, such as withholding tax exemptions on interest income from green bonds, to spur investment.

Despite the capital markets offering an avenue for long-term local currency funding and domestic resource mobilisation, it remains largely underutilized as sustainable finance capital inflow in Kenya has been supported by several external sources including Development Finance Institutions (e.g. International Finance Corporation, European Investment Bank and Africa Development Bank), Multilateral Development Banks (MDBs), Multilateral Climate Funds (like the Green Climate Fund and Global Environment Facility), as well as government contributions and private sector players. Over the last five years, six public bonds have been issued in the Kenyan capital market, with only one being a green bond, a telling indicator that this avenue for capital raising remains untapped. While we recognise that multiple private and bilateral green financing transactions have occurred in the Kenyan market over the same period, we note that one prominent private green note issuance from Burn Manufacturing USA LLC (Kenya Branch) occurred in October 2023 for financing clean cookstoves across Sub-Saharan Africa.

To further catalyse growth at a sub-national level, Financial Sector Deepening Kenya (FSD Kenya), in collaboration with Agusto & Co. and other partners, assessed 10 Kenyan counties to develop an inclusive green finance ecosystem. This initiative involved credit risk assessments, the identification of green investment opportunities in areas like renewable energy and climate-smart agriculture, and an evaluation of the counties’ capabilities to manage green financial instruments. These counties are now better prepared to tap into green finance for their development projects.

Conclusion

While there is rising demand for sustainable finance in Kenya, challenges such as knowledge gaps, policy complexity and a limited pipeline of viable projects persist. Nevertheless, financial institutions are strategically positioned to mobilise capital for sustainable development. The path forward is clear. With agriculture as its economic backbone and a major government focus on housing through the BETA plan, Kenya has an immediate opportunity to issue green and social bonds through its capital markets. These instruments can directly fund climate-smart agriculture, renewable energy, affordable green housing, gender equality initiatives and youth entrepreneurship. In addition, Agusto & Co. believes that the KGFT, which provides eligibility criteria for 11 sectors, presents an opportunity for operators in these segments to tap into the capital markets to raise funds for impactful project and steer the country towards a greener and more resilient future.

To accelerate this, Kenya must continue to enhance its capital market infrastructure, simplify regulatory frameworks and diversify its product offerings, including instruments like Sukuks and asset-backed securities. As issuers commit to these initiatives, they should leverage existing local and international frameworks and verification partners to ensure transparency and credibility. Kenya’s commitment to sustainable finance is not just timely—it is essential for its long-term endurance, resilience and transformation.