Pensions provide financial security in retirement, funded by contributions from the working population. By the end of the 2024 financial year, global pension assets reached USD 63.1 trillion, marking an 8.5% annual growth driven by strong investment returns and the expansion of defined contribution schemes. The U.S. market alone, valued at USD 38 trillion or 130.3% of its GDP, underscores the immense scale of these capital pools. Globally, asset allocation is increasingly shaped by government regulation and a strategic shift towards alternative investments like private equity and infrastructure to secure higher returns. While this diversification can foster economic growth, an over-concentration of pension assets in government debt, a common practice, exposes these vast funds to significant sovereign risk, creating the potential for systemic failure.

Pension Funds and Government Debt: Rising Vulnerabilities in Africa

Across many African countries, pension funds have become key financiers of government debt owing to their relative affordability and accessibility compared to foreign borrowing. While this developing trend has supported fiscal needs, it has also exacerbated public debt levels, increasing exposure risks for pension funds. Pension systems across the continent often suffer from limited asset diversification, low coverage driven by a large informal sector, and inadequate public awareness. Strengthening these systems requires broadening investment portfolios, enhancing public sensitisation, and leveraging demographic opportunities. In 2019, the Africa Pension Supervisors Association (ASPA) was established to provide regulatory support, capacity building, and networking across fifteen African countries. Despite an estimated 56.5% of pension assets under management (AUM) across selected countries still being invested in government securities, some nations, such as Namibia, have begun diversifying their portfolios, with only 28% of pension AUM allocated to government securities in 2024. Such diversification is essential for spurring economic development, protecting contributors’ interests, and fostering sustainable pension fund growth.

Figure 1: Allocation of pension assets to government securities in selected African countries in 2024 (%)

Source: Pension reports from selected African countries

Kenya’s Pension Landscape Amid Domestic Debt Expansion

As at 30 April 2025, Kenya’s total public debt stood at Kshs 11,490.4 billion, with domestic debt representing 53.6% of this figure. Over the past five years, domestic borrowing has grown steadily as the government seeks to mitigate external shocks, emphasising the importance of well-capitalised local investors such as pension funds. According to the Retirement Benefits Authority (RBA), pension AUM reached Kshs 2.3 trillion by the end of 2024, approximately 14.6% of GDP, projected to rise by 8.6% to Kshs 2.5 trillion by year-end 2025.

Nevertheless, 92% of these assets remain concentrated in four asset classes: government securities, guaranteed funds, immovable property, and quoted equities. This high concentration, particularly in government securities, coupled with growing public debt and elevated costs of debt servicing, poses significant risks. The burden of servicing debt absorbs sizeable portions of Kenya’s recurrent expenditure and could crowd out developmental spending. Kenya’s pension system must therefore pivot towards diversified investments aligned with global trends to ensure more resilient and higher-yielding returns.

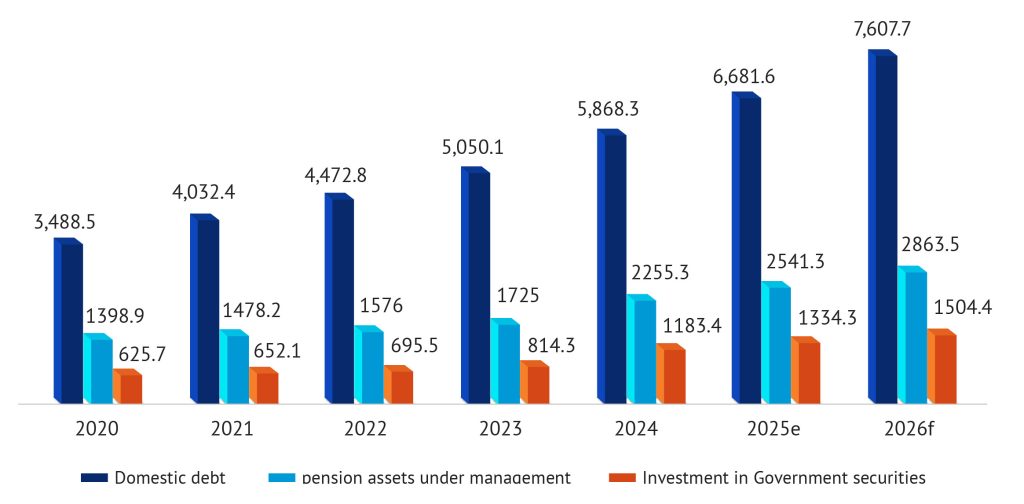

Figure 2: Kenya’s National Government Outstanding Debt (2019 – 2026f), Billions KSHS

Source: Central Bank of Kenya (CBK) and Agusto & Co. Research

Fiscal Consolidation and Debt Management Strategies

Kenya’s debt trajectory has generally increased over recent years, except for a slight 1.9% decline in 2024. The 2025 Budget Policy Statement highlights fiscal consolidation as a critical strategy to stabilise debt growth, requiring ministries and government agencies to prioritise and rationalise expenditures accordingly. Recognising the inevitability of borrowing to fill budget gaps, the government plans to diversify funding sources by issuing innovative debt instruments – including green sustainable bonds, samurai bonds, panda bonds, sukuk, and debt swaps, as set out in the 2023–2027 Medium-Term Strategic Plan. This strategy seeks to reduce dependency on principal financiers such as pension funds and diminish concentration risk in public debt instruments, thereby fostering a more resilient debt portfolio.

Pension Fund Investment Behaviour and Risks

Pensions, mandated to secure contributors’ futures, naturally adopt a risk-averse investment stance, favouring government securities for their perceived safety. At the end of fiscal 2024, 52.5% of Kenya’s pension assets were invested in government securities, a figure well below the RBA’s statutory cap of 90% but still reflective of substantial concentration risk. The increasing sovereign debt has created opportunities for domestic investors to earn higher returns, with pension holdings in government securities rising by 46% year-on-year in 2024 due to attractive interest rates.

While this arrangement currently provides seeming stability, yielding higher pension fund returns and steady government funding, it harbours long-term vulnerabilities. Should interest rates decline or public debt become unsustainable, pension funds and the broader economy face considerable risk. Balancing safety, returns, and economic stimulation remains a delicate but necessary pursuit.

Figure 3: Domestic Debt, Total Pension AUM, and Pension AUM in Government Securities (Billions KSHS)

Source: CBK data, RBA Industry Brief and Agusto & Co. Research

Budget Priorities and Opportunities for Pension Assets

The 2025/26 financial year government budget allocates 72.6% to recurrent expenditure, a reduction from 85.3% in the previous year, thereby limiting funds for developmental projects essential to real economy growth. The fiscal deficit is expected to be predominantly financed domestically (68.8%), with pension funds as the largest institutional investors. Since October 2024, interest rates have declined from their previously high levels, emphasising the need for robust, diversified investment strategies that ensure sustainable medium- to long-term returns.

Pension funds should reduce their reliance on government debt instruments and reallocate assets towards the real economy through rigorous credit risk assessment. Alternative investments in infrastructure, public-private partnerships, real estate, sustainable energy, and affordable housing represent promising avenues that address Kenya’s development challenges while offering better risk-adjusted returns. Moreover, active fund management, including negotiation for improved rates and real-time performance monitoring, would optimise outcomes for contributors and support broader economic progress.

Structural Challenges in Pension Fund Administration

Kenya’s pension ecosystem comprises various schemes regulated by the RBA. Fund managers control 78.9% of pension AUM, while the National Social Security Fund (NSSF), mandatory for formal sector workers, accounts for 21.1%, holding Kshs 476.8 billion in net assets. The Public Service Superannuation Scheme (PSSS) manages Kshs 242.8 billion, covering teachers, disciplined forces, and civil servants.

Government-affiliated pension funds grapple with challenges including rising unfunded liabilities and unpaid contributions, exacerbating liquidity issues and delaying benefit payments. These problems impose mounting fiscal pressures via ballooning pension obligations and highlight vulnerabilities in the sustainability of future payouts. Although regulatory protections exist, effective pension security hinges on maintaining strong reserves and responsible fund management. Sophisticated credit analytics and market research should underpin strategies to expand and diversify pension holdings, enhancing long-term viability.

The Imperative of Timely Payouts and Informal Sector Inclusion

Ensuring timely pension disbursements is crucial to maintaining social security protections. Kenya’s life expectancy of 67.9 years implies beneficiaries will draw pensions over protracted periods, increasing demands on fund reserves. Retirement payments have generally increased, with a 7.6% rise to Kshs 127.8 billion in 2024, a trend expected to persist as more workers retire. We believe that pension schemes must innovate inclusive products targeting the informal sector to broaden the contributor base and not just reallocate existing assets. A diversified, growing pension reserve will mitigate sector exposure, enhance economic impact, and secure contributors’ futures.

Strategic Diversification to Mitigate Sovereign Risk

The overconcentration of pension funds in government securities heightens exposure to sovereign risks exacerbated by Kenya’s growing public debt. Institutional investors are vital domestic finance sources but must embrace innovative and strategic management practices to preserve pension promises. Within statutory limits, asset allocation should be adjusted periodically through in-depth market research and risk assessment reflecting macroeconomic shifts and contributor needs. Agusto & Co. recommends that pension managers increase allocations to alternative asset classes, safeguarding the pension system against fiscal volatility and ensuring sustainable future returns.

Conclusion

The rising exposure of pension funds to sovereign risk signals a potential systemic failure that demands timely and effective intervention. To secure the future promises of pension beneficiaries, pension asset managers must prioritise strategic diversification into alternative instruments as the government continues to manage its expanding debt burden. Optimising pension AUM allocation will enhance future yields, generating beneficial ripple effects for the current economy. These strategic interventions are essential to ensure that the tomorrow’s promises are not mortgaged by Kenya’s present fiscal pressures.