Introduction

Kenya’s credit market has undergone a remarkable transformation over the past decade, shaped by policy shifts that sought to balance the affordability of credit with financial stability. Perhaps the most disruptive reform was the interest rate cap introduced in September 2016, which set the maximum lending rate at 400 basis points above the Central Bank Rate (CBR) and the minimum deposit rate at 70% of the CBR. The intention was to make credit cheaper; spur borrowing among households and small businesses and foster financial inclusion. Yet, the caps produced the opposite effect. Banks, faced with squeezed margins, became more risk-averse. Credit to small and medium enterprises (SMEs) and households shrank, while lending shifted toward safer corporate clients and government securities. Nonetheless, as at the time the rate caps were repealed in November 2019, it was clear that while well-intentioned, rigid interest rate controls had created inefficiencies, hurt financial intermediation and limited access to credit. This experience laid the groundwork for a new approach, one that balances affordability, transparency and risk differentiation while preserving the stability of the banking system.

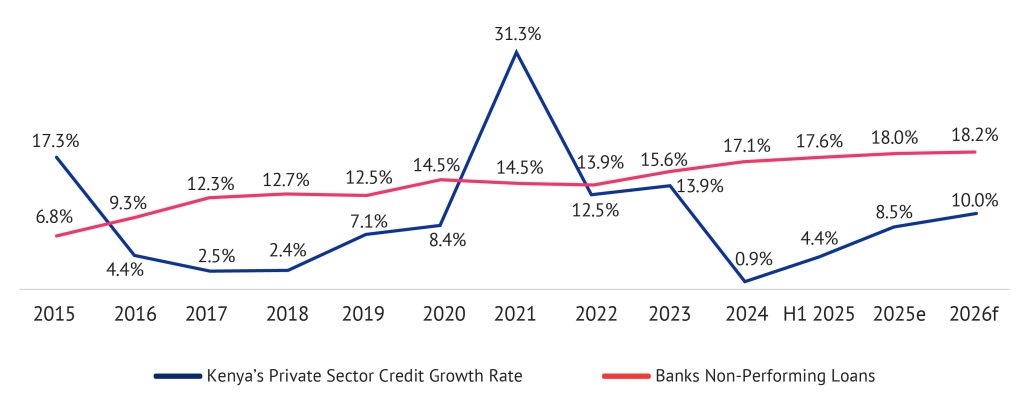

Figure 1: Kenya’s Private Sector Credit Growth Rate (%)

Source: Central Bank of Kenya, Agusto & Co. Research

On 26 August 2025, the Central Bank of Kenya (CBK) unveiled a revised Risk-Based Credit Pricing Model (RBCPM), anchored on a new market reference rate: the Kenya Shilling Overnight Interbank Average (KESONIA). KESONIA is a fundamental departure from the previous policy-driven benchmarks. Derived from the overnight interbank lending market, it reflects the actual, real-time cost of funds between banks, aligning Kenya’s benchmark structure with global standards such as the United States’ Secured Overnight Financing Rate (SOFR) and the United Kingdom’s Sterling Overnight Index Average (SONIA).

Under this new regime, lending rates will be determined as:

- Total Lending Rate = KESONIA + Premium (“K”), where “K” reflects banks’ operating costs, return to shareholders and most importantly, the borrower’s risk profile.

- Therefore, the Total Cost of Credit = KESONIA + K + Fees and Charges

Borrowers will now clearly see how their rates are derived from market funding costs to institutional margins and individual credit risk. KESONIA will apply to all variable-rate loans, while fixed-rate and foreign currency facilities may continue using alternative benchmarks such as the CBR.

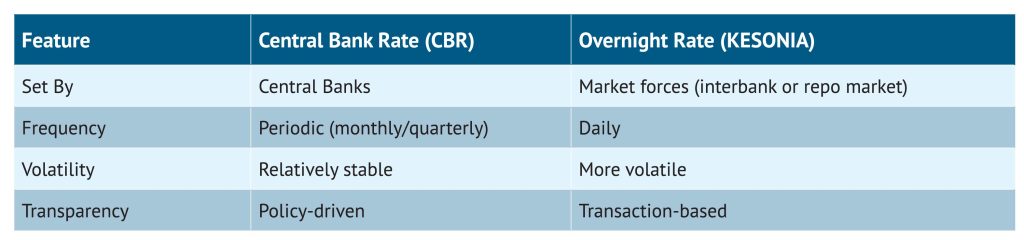

Understanding the Shift: From Central Bank Rate to KESONIA (Overnight Rate)

The innovation under the revised framework is the replacement of the policy-driven CBR with the market-determined KESONIA, which reflects real-time funding costs and enhances pricing transparency.

Table 1: Key Differences Between Rates

Source: Agusto & Co. Research

Regional Shifts Toward Overnight Benchmark Rates

Kenya’s adoption of KESONIA mirrors a growing regional trend toward overnight, transaction-based benchmarks designed to enhance transparency and market responsiveness. In South Africa, the Johannesburg Interbank Average Rate (JIBAR) is being gradually replaced by the South African Rand Overnight Index Average (ZARONIA), which reflects real interbank funding costs and aligns domestic markets with global reforms such as SONIA. Similarly, Morocco’s Overnight Index Average (MONIA), introduced by Bank Al-Maghrib in 2020, anchors short-term interest rates to actual liquidity conditions.

These experiences highlight a clear regional shift as policymakers are moving away from administered or policy-driven rates toward data-backed, market-derived benchmarks that improve price discovery and risk differentiation.

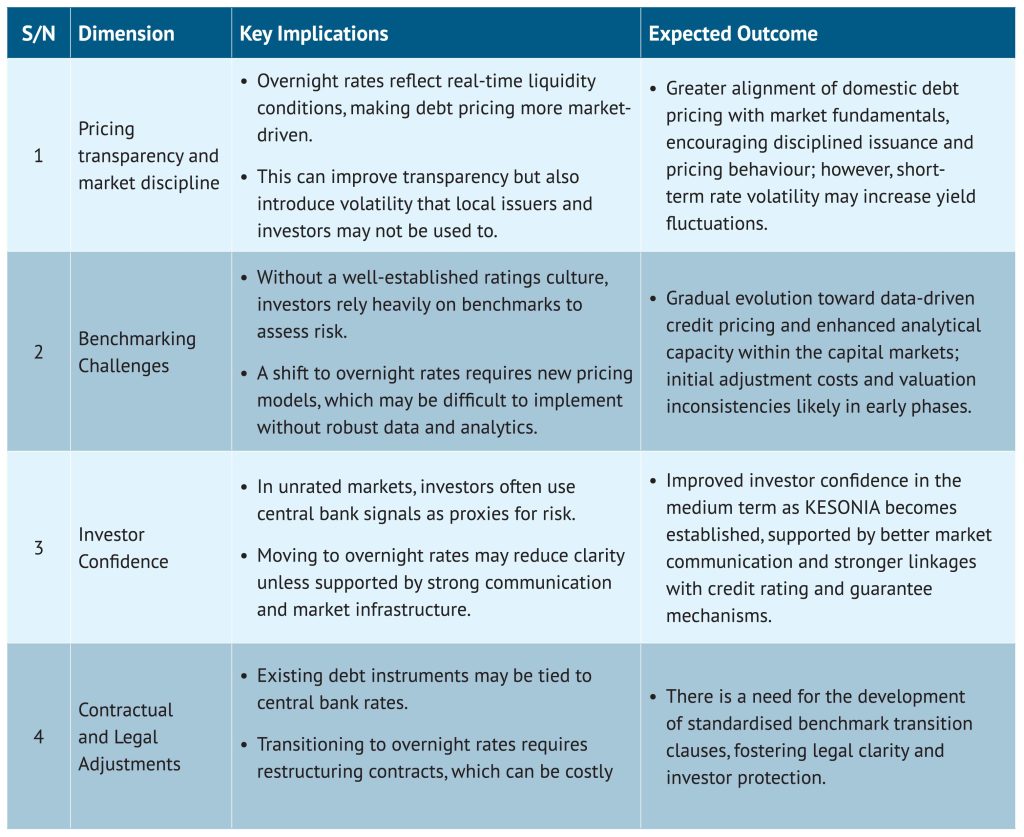

Implications for Debt Market Development

The adoption of a market-based reference rate represents a pivotal evolution in Kenya’s financial architecture. By linking debt pricing to real-time interbank liquidity, transparency is enhanced, moving the market closer to global best practice. Nevertheless, the transition also introduces new dynamics that could influence pricing behaviour, investor sentiment and legal frameworks. Below, we outline the key dimensions of this shift and their expected outcomes for Kenya’s debt market development.

Table 2: Impact of KESONIA on Kenya’s Debt Market Development

Source: Agusto & Co. Research

Overall, the KESONIA framework’s success in deepening the debt market will depend on the market’s capacity to adapt to higher volatility, strengthen data ecosystems and build investor trust through clear communication and sound legal frameworks.

Credit Ratings: Building the Foundation for Risk-Based Lending

As Kenya transitions to the KESONIA-based model, the need for credible credit ratings becomes increasingly evident. Today, many lending decisions still lean heavily on collateral or relationship-based assessments, rather than objective measures of borrower quality. This limits transparency and, crucially, constrains access to affordable credit, particularly for essential real-sector borrowers, including SMEs, manufacturers and agribusinesses.

Establishing a robust credit rating culture is essential. It enables banks to better differentiate risk, assign appropriate premiums and support lending based on financial behaviour rather than mere asset ownership. For unrated or first-time borrowers, a rating serves as a “financial identity,” building credibility and investor confidence, as well as enhancing market access. As KESONIA anchors a more market-driven credit ecosystem, integrating credit ratings will be essential to achieving balanced risk pricing, expanding inclusion and strengthening overall financial stability.

Agusto & Co. notes that in a landscape where many institutions still rely on collateral or internal scoring, the absence of robust rating adoption presents both friction and opportunity for market evolution.

- Risk Assessment Gaps: Without standardised ratings, risk evaluation remains subjective. This can magnify volatility under the new overnight rate regime, leading to inconsistent pricing and wider credit spreads.

- Limited Investor Participation: Institutional and international investors typically prefer rated instruments, and the lack of ratings may restrict their involvement, slowing debt market growth and limiting foreign capital inflows.

- Need for Alternative Risk Tools: Banks and regulators may lean on proxy solutions such as portfolio guarantees, internal risk models, or blended finance structures to bridge the credibility gap left by absent ratings.

Ultimately, the development of a strong credit rating culture will determine how effectively the country’s debt market can transition from policy-driven lending to data-driven credit risk assessment. Building confidence through credible ratings will not only anchor investor trust but also accelerate the deepening and competitiveness of Kenya’s financial market.

Unlocking Credit Confidence: How Guarantees Can Lower Borrowing Costs Under KESONIA

Credit guarantees are emerging as a vital bridge between credit risk and lending confidence under the new risk-based credit pricing model. While credit ratings help identify borrower risk, credit guarantees actively help reduce that risk. Entities like the Dhamana Guarantee Company serve as a vital bridge, sharing potential losses with lenders, particularly for segments deemed too risky, such as SMEs and agricultural lending.

By reducing expected losses, guarantees allow banks to lower their capital provisioning requirements, extend more credit and price loans more competitively. Agusto & Co. notes that the presence of a credible guarantee can significantly compress the “K” spread, the risk premium added to lending rates, by enhancing credit quality and confidence in repayment. This innovation creates room for structured finance and blended finance instruments, channelling funds to underserved borrowers. Robust governance, adequate capitalisation, and sound risk management are, however, critical to ensure sustainability and prevent concentration risk, as emphasised by the draft CBK regulations. Overall, the guarantees which complement credit ratings will turn risk assessment into actionable lending confidence under Kenya’s evolving credit ecosystem.

Conclusion and Outlook

Kenya’s embrace of the KESONIA-based credit pricing model represents a structural shift towards a more transparent, data-driven and market-responsive credit system. By anchoring lending rates on real market activity, and embedding complementary mechanism such as credit ratings, guarantees, and credit bureau integration, the framework aims to deepen financial discipline, enhance pricing fairness, and sustainably expand credit access. The publication of KESONIA by the Central Bank of Kenya daily will also anchor market expectations, foster interbank liquidity and strengthen the transmission of monetary policy into the real economy.

To sustain the momentum and unlock the full benefits of this reform, some strategic interventions will be key. First, developing a local yield curve anchored on overnight rates would help guide loan and bond pricing, providing a transparent reference for both lenders and investors. Second, expanding credit guarantee schemes and risk-sharing mechanisms can offset perceived risks in SME and agricultural lending, improving capital efficiency and inclusion. Third, strengthening financial market infrastructure, particularly trading platforms, clearing systems and real-time data transparency, will support efficient price discovery and liquidity. Finally, encouraging the adoption of credit ratings through regulatory incentives or supervisory guidance can institutionalise risk differentiation and foster a stronger credit culture.

Overall, Agusto & Co. believes that the long-term success of the KESONIA-driven model hinges on the effective execution of these complementary reforms. Building a yield-curve-based pricing environment, promoting guarantee uptake, and deepening the use of ratings will collectively transform Kenya’s credit ecosystem into a more resilient, competitive and inclusive market. If implemented with discipline and transparency, KESONIA could become the cornerstone of a modernised financial system, one that translates risk awareness into sustainable and affordable lending.